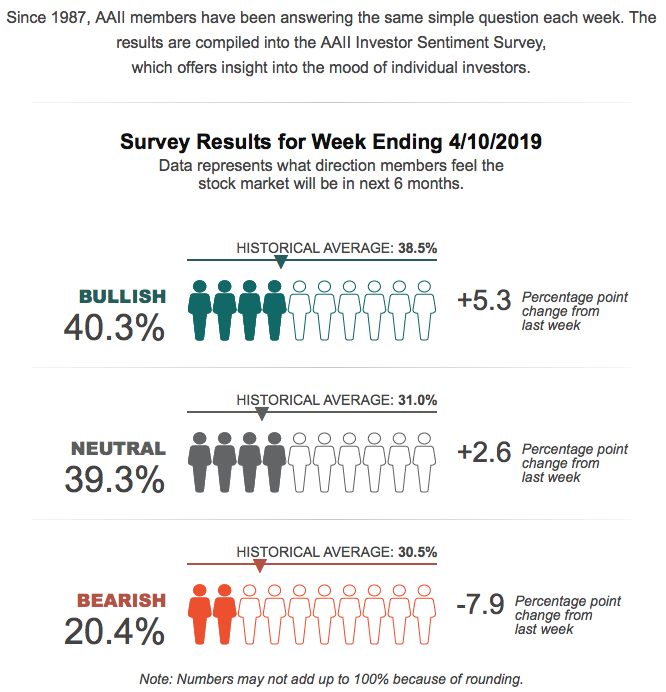

The Most Hated Bull Market of My Career. Stunning Investor Sentiment Readings. VRA Investing System Nearing 11 of 12 Screens Bullish.

/Good Thursday morning all. To give you an idea of just how out of whack investor sentiment is, with US markets just 5% or so away from all time highs, check out last nights AAII Sentiment Survey reading. 21.7% bulls (down 16.8% on the week) with 48.2% bears (up 48.2% on the week).

Read More