VRA Weekly Update: Q3 is Here. Welcome to Best Day and Best Two Weeks of the Year.

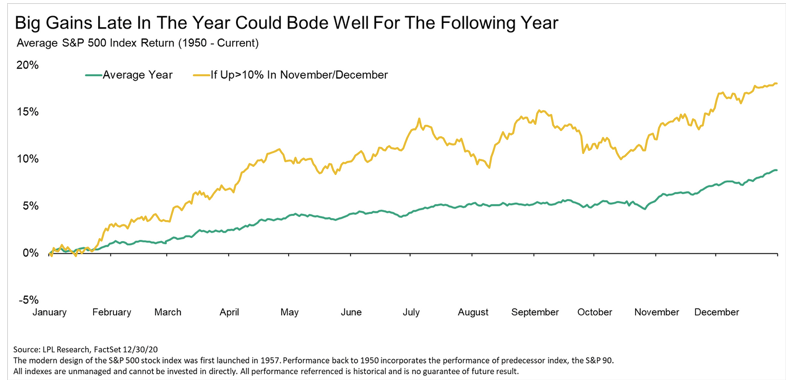

/Good Thursday morning all. Excellent day in the Dow Jones yesterday (+210…we love both the Dow and R2K charts here) but slow summer-like day elsewhere. ATH’s once again in S&P 500 and we’ve now had back-to-back-to-back days with ATH’s in the semis as SMH put up a bit of a furious rally…

Read More